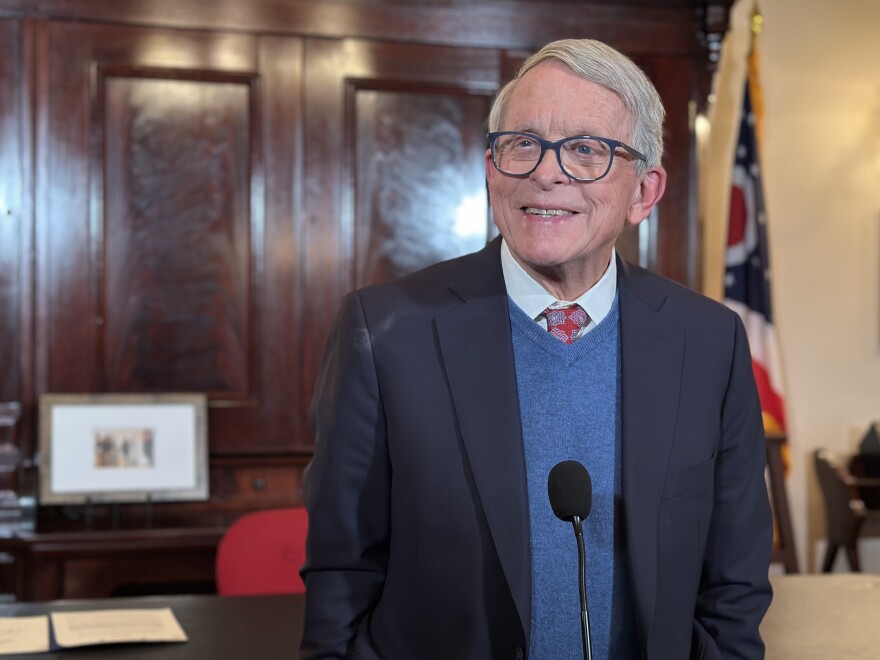

Gov. Mike DeWine made his pitch Monday to lawmakers about where to put state dollars in his fourth and final biennial budget proposal, which runs a price tag of $61 billion worth of general revenue funds.

With federal funding accounted for, the budget totals $108 billion in fiscal year 2026 and $110 billion in fiscal year 2027, said Kim Murnieks, Ohio Office of Budget and Management director.

The themes are familiar, DeWine said, focusing heavily on children and families—as well as education, mental health service, and safety and community.

Among some priorities he outlined at a Monday press conference were creating a new child tax credit, establishing a children’s vision services program called OhioSEE, hiking taxes on cigarettes and cannabis and gambling, finishing funding Next Generation 911 services, and overhauling how the state funds construction of and renovations to professional stadiums.

The $1,000 per year and per child tax credit would be provided to parents through a child’s sixth birthday, DeWine said. It would be refundable, and at least some portion would be available to parents with a joint income of $94,000 or less, according to budget documents.

“This will be a significant amount of money,“ he said. “It will help these families, help these families move forward with their lives however they want to live those lives, and so I’m frankly very excited about it.”

Creation of the child tax credit would be funded by boosting taxes on cigarettes and other tobacco products. DeWine has proposed raising the per cigarette pack rate from $1.60 to $3.10, a $1.50 increase, and raising the wholesale tax on other products from 17% to 42%, according to budget documents.

Funding for K-12 schools, including through vouchers for non-public schools, came in at $23.4 billion, he said. That includes the final phase of the Fair School Funding plan, which began in 2021 and school funding based on tax and income levels.

In addition to nearly doubling the sales tax on cigarettes and other tobacco products, DeWine has proposed doubling the sports gambling tax that proprietors—like brick-and-mortar and online sportsbooks—have to pay on profits, from 20% to 40%. He called proprietors “extremely aggressive.“

“They’re in your face all the time,“ DeWine said. “They’re getting Ohioans to give them, to lose massive amounts of money every year, and it seems to me only just and fair that some of the stadiums be paid for by them, or a portion of it.“

Increased revenue from the increased tax would go toward a newly-created Sports Facilities Construction and Sports Education fund. That pot would put money to professional stadiums, major and minor league, and benefit youth athletics, he said.

DeWine’s nearly 600-page budget is now in the hands of lawmakers in the Ohio House. The House Finance Committee is scheduled for budget hearings starting Tuesday morning.